A Note From David

“I am incredibly proud of how, we as the Liberty community, have stood tall and delivered on the priorities we set for ourselves, notably by supporting our clients – particularly those that were most vulnerable. Your commitment, combined with the robustness of our business, meant that we continued to preserve our financial resilience, and were able to keep our promises to our clients…”

Dear Colleagues

It’s close to a year-and-a-half since the start of the COVID-19 pandemic, and with vaccination programmes advancing globally we are starting to see the beginning of the end of this unprecedented period in world history. Even as we find ourselves past the peak of the third wave of the pandemic in South Africa, my hope is that as the year draws to a close, we can all start to return to a more familiar way of life.

I am incredibly proud of how, we as the Liberty community, have stood tall and delivered on the priorities we set for ourselves, notably by supporting our clients – particularly those that were most vulnerable. Your commitment, combined with the robustness of our business, meant that we continued to preserve our financial resilience, and were able to keep our promises to our clients.

By now you would have had time to reflect on the proposal by the the Standard Bank Group to buy out the minority shareholders of Liberty, bringing its ownership to 100 percent.

I would like to reiterate that the strategic benefits of us being fully owned by the bank are numerous and compelling. I trust you share my enthusiasm about our future prospects. The proposed transaction will enhance Liberty’s ability to meet the financial needs of clients more effectively. Standard Bank Group’s banking, private client asset management and short-term insurance capabilities will complement our long-term client relationships. Importantly, there is significant opportunity for growth and scalability of a fully integrated client offering throughout the bank’s existing operations.

The transaction is anticipated to be finalised by the first quarter next year, until then its business as usual.

Results Highlights

While equity markets have regained some of the ground lost since March 2020, strained economic conditions have persisted over the past six months. Consumers and businesses alike remain under considerable pressure as a result of increasing unemployment and a decline in household savings.

As we anticipated, these significant challenges have had a dampening effect on our results for the six months.

Key results takeouts

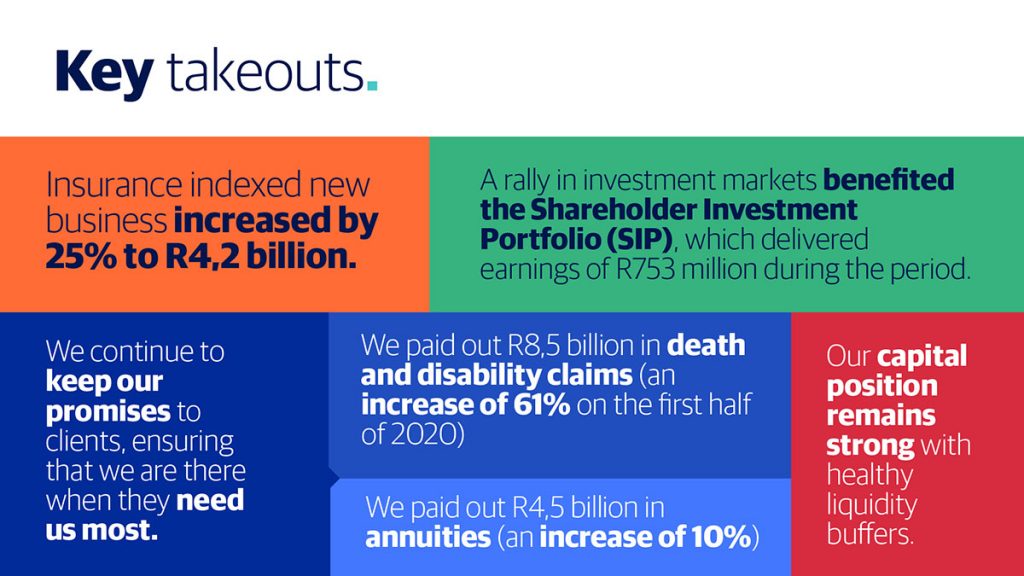

- Following significant efforts from all our sales channels insurance indexed new business increased by 25% to R4,3 billion, which in these challenging times is an excellent outcome.

- Although the value of new business remains a challenge, our management team are focused on initiatives to improve it.

- We paid out R8,5bn in death and disability claims, an increase of 61% on the first half of 2020, and R4,5bn in annuities increasing 10%. These actions bear testament to the fulfillment of our promises to clients, and the delivery by Liberty on its purpose.

- The Shareholder Investment Portfolio (SIP) benefited from the investment markets rally during the period delivering earnings of R753 million.

- Our capital position remains strong following a slight increase in the pandemic provision, with healthy liquidity buffers.

We must stay true to our purpose

By staying true to our purpose at Liberty, especially in these challenging times, we demonstrate the critical role we play in supporting our clients; be it in their moments of most profound vulnerability or achieving their hopes, dreams and aspirations into the future. Improving people’s lives by making their financial freedom possible is not something we take lightly, it is what we fundamentally believe we must do as a business, through the value we contribute to our clients, shareholders, employees and society.

To this end, I would like to thank all of you for your effort in the first half of 2021. We are a community of amazing people doing extraordinary things in unimaginable times.

Regards

David

Liberty Holdings – Interim Financial Results Report June 2021

A Note From Johan

Dear Valued Business Partners,

Liberty released our financial results for the six months ended 30 June 2021. Here’s a brief summary.

Results Highlights

The first six months of the year have again been difficult for consumers and businesses. They remain under financial pressure from reduced incomes, increasing unemployment and a decline in household savings. In spite of all the complexity we experienced in the first six months of this year, normalised operating earnings increased by 3% on 2020.

The X-factor: our people

As a large business with shareholders and other stakeholders to whom we are accountable, the numbers are undeniably important. However, they cannot be more important than the value of the people who deliver those numbers and the successes that help us achieve them.

Over the last six months – and the 12 months before that – each and every one of us has been impacted by the force of COVID-19.

We have lost loved ones and colleagues; we have suffered our own illnesses, grief, fears and anxieties; and we have adapted and adjusted to the changes thrown our way. Through it all, you have continued to offer advice and solutions to your clients and independent advisers, and helped them through the challenges that have touched so many of them.

On The Right Track

The pandemic has increased consumers’ expectations of their life insurance partners. This is a fundamental driver of the changes we are making to our business. As our digital tools, systems, and propositions come online, I am confident that we are on the right track with our business strategy.

Another step on this journey, of course, is Standard Bank Group’s proposal to buy out the minority shareholders of Liberty and fully integrating Liberty into the greater group.

The strategic benefits of this proposed transaction are numerous and compelling. The most exciting part, is that it will enhance the company’s ability to meet the financial needs of clients more effectively, making possible holistic advice and competitive solutions for them, especially during major transition points in their lives.

All in all, I believe that we can stand proud as we reflect on the last six months. We have dealt with the constant set of new challenges by prioritising and accelerating key initiatives that are fundamental to the strategic progress of Liberty. The launch of Liberty Adviser Workbench and Advice+ as part of our digital transformation have received positive feedback and we are already starting to see the benefits of these tools. They bring us another step closer to delivering truly personalised client solutions and experiences.

We need to stay focused on giving great advice and supporting our clients when they need us most. We must trust that the plans already underway to improve our claims experience, streamline our communications and improve our service will help our clients to feel the full value of Liberty going forward.

We know that there are no easy answers or shortcuts in the months that lie ahead, but if we keep our eyes on the goal, we will succeed in our aim to simplify and transform our business, and ultimately deliver an excellent client and adviser experience.

Finally, I would like to say to all our front line sales and advisory force, Well done! You have shown your true character the past six months… It has been a tremendous effort and one that did not go unrecognised. I am truly proud to be part of this team and look forward to the next six months. All of the very best.